North Cyprus Inheritance & Probate

When somebody dies, probate proceedings are necessary in order to transfer his/her assets/estate (such as house or holiday home, land, cars or other vehicles, money, money in bank accounts, personal property and shares) to heirs according to inheritance rules and regulations.

We can help you to set up probate to transfer and distribute the assets, avoid paying unnecessary inheritance tax and make sure that you get your right share from the estate. We have a highly experienced litigation team for contentious cases if there is a disagreement between the heirs or irregularities in the probate procedures.

Stages of North Cyprus Probate

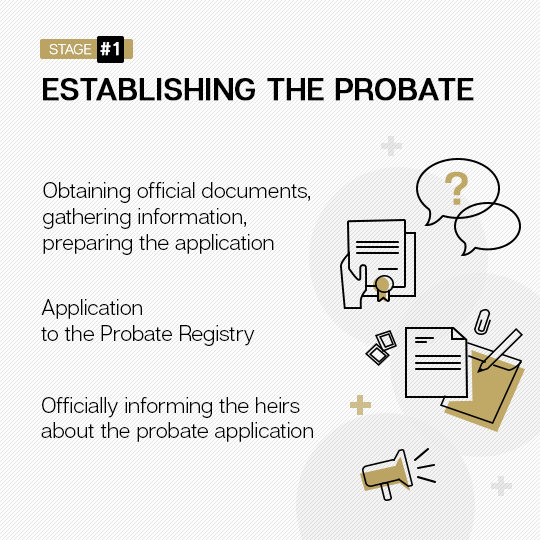

Starting Probate

The estate of the deceased person, which includes immoveable and moveable properties, in North Cyprus can only be transferred by establishing a probate at the probate registry office. One or more administrators are appointed in order to distribute the estate to the heirs. The administrators have a duty to look after the estate until they are distributed. They also have the responsibility of distributing the assets to the heirs as per their legal rights.

Establishing the probate requires an application to be made to the probate registry office in the required format together with certain documents that need to be acquired from other governmental offices.

A related person to the deceased or a creditor of the deceased may establish the probate. The heirs are notified of the probate according to the probate procedures unless an alternative notification method is obtained from the court or heirs give their written consent for the probate to go ahead.

Once the service of notices stage is completed, the probate is usually established between 7 to 14 days following submission of these documents.

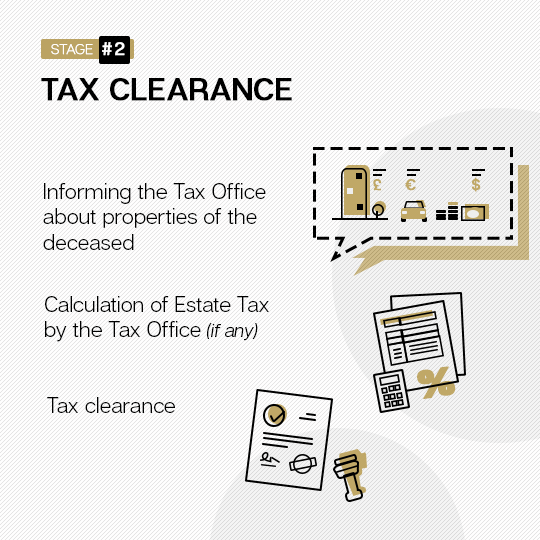

North Cyprus Inheritance Tax

Generally speaking, in order for the properties of the probate to be transferred to the heirs, they must be reviewed by the tax authority. In practice some banks in North Cyprus may accept to give the money of deceased to the administrator of the estate before this stage is completed.

There is no inheritance tax in North Cyprus up to the total ownership amount of 3,255,120 TL (applicable as of 3/1/2023).

Above this, inheritance tax in North Cyprus is 1% of the remaining amount.

The ownership amount includes combined values of assets and debts. Assets include immoveable properties, such as houses, lands; and movable properties such as money, company shares, cars and other personal items.

The tax authority also checks whether there are other tax debts of the deceased or whether there are tax charges on these properties.

Once the tax implications, if any, are satisfied, the administrators would proceed to transferring of the estate to the heirs.

Calculator

Rights of Heirs

If the deceased does not have a valid will which is enforceable in North Cyprus, the estate is distributed according to North Cyprus inheritance law. You can see a summary of the distribution rules below.

If the deceased has a valid will which is enforceable in North Cyprus, the will is applied according to the North Cyprus law.

It is important to note that, some of the rights of some heirs are protected by North Cyprus law. Therefore, the will is reviewed as per the regulations in place before its application.

Calculator

Calculator

Calculator

Contact Us For Free Consultation

E-mail | info@nekibzade.com

Telephone | +90 533 863 7599

Whatssapp | +90 533 863 7599

Viber | +90 533 863 7599

Website | Or message us by using our following contact box